What Is Private Equity Investment and How It Impacts Your Portfolio

Do you know almost $100 billion of capital has been invested in the private equity market in India over the last 13 years? This revolutionary investment approach has restructured the growth strategy for many small and medium-sized businesses. In 2017, the volume of private equity investment was around $26.5 billion, and the momentum is expected to increase in the coming years. If you wish to learn more about private equity firms and investment structures, this write-up will give you detailed insights. You can cut through the chase by connecting with trusted private equity fund brokers at Stockify.

What is Private Equity?

Private equity is a new fund-sourcing approach where companies collect funds from private firms or accredited investors rather than traditional stock markets. The end goal of private equity investment is to boost the company’s financial performance so it can go public and get acquired by big entities.

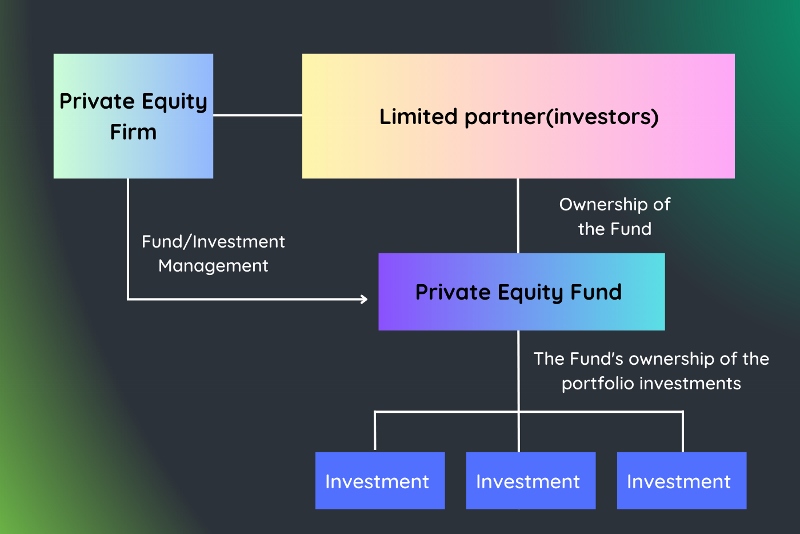

Here is the graphic to give you a better understanding.