The global market of online travel agencies is expected to grow at a CAGR of 11.5% from 2023 to 2028. At this pace, its valuation will increase from USD 459.7 billion in 2022 to USD 942.3 billion in 2028. Online Travel Agencies (OTA) like Cleartrip aim to set a strong foothold through various market strategies in the massive industry. In recent months, Cleartrip has announced the onboarding of many airlines to offer affordable flight tickets to its users. The cheaper travel options will attract more customers to the OTA.

What Does The Move Mean For Users, Cleartrip, & Stockholders?

The move significantly impacts different fronts and means different advantages for everyone. For the consumers, there comes an addition in the airline option and a substantial price cut in the flight rates. For Cleartrip, the strategy will allow the company to bring a unique selling point to the travel market as it can now provide options, comfort, and unrivalled prices to its consumers. Moreover, the increased ROI and profit margins in the near future will favour Cleartrip share price. Therefore, onboarding new airlines is advantageous to everyone associated with Cleartrip. Let us explore it in detail now.

Shift In Travel Trends As The Leading Market Driver

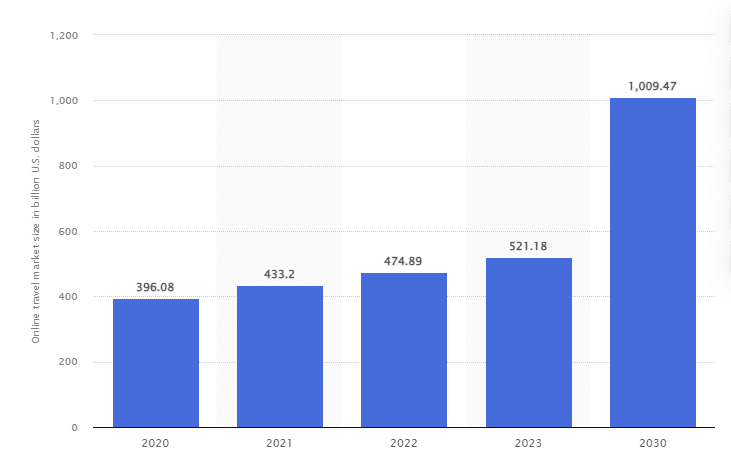

The profitability of the large investments of Cleartrip will be determined by the market behaviour of online tourism and bookings. The statistics and market predictions by the leading analysts favour these ventures. The graphical representation by Statista shows the exponentially expanding global market of online travel agencies. The values in the vertical axis are in billion US dollars.

The market has been propelled by vast shifts in travel trends in recent years. The new customs have been business-leisure and food tourism. The hybridisation of business and leisure has given way to bleisure trends that inspire working professionals to explore local cuisines and travel destinations during their business trips. This has increased the popularity of tourism to working days and generated colossal cash flows from organisations on expensive trips. Moreover, the food industry is expanding the authentic culinary experience it provides. People’s growing interest in the indigenous delicacies of many countries and regions has fuelled the growth of the tourism market and online travel bookings subsequently.

Also Read: OYO Becomes The Biggest Hospitality Tech In Indonesia

However, it is not the case that there are no restrictions to the present growth scenario of online travel agencies. Geopolitical tensions and problems like economic slowdown and inflation are certain hurdles in the OTA’s growth. However, positive factors like increasing demand from solo travellers, customer acquisitions in the online travel industry, and the growing popularity of tourism in business trips more than overcome these hurdles.

The Unique Selling Points Of Cleartrip

India’s fastest-growing player in the online travel market, Cleartrip, is driving a market revolution in real-time. It intends to single-handedly shift flight tickets from price-led marketing trends to a choice-led position for consumers. Where discount wars and changing wars dominate the front seats in the cinema of the Indian travel sector, Cleartrip silently takes the balcony with its unique positioning in the market.

The 15-year-old Flipkart brand has already been the customer’s preferred with its easy-to-use interface and excellent customer support. Moreover, it has customer-oriented booking options, a considerable presence in the international travel market, and partnerships with hotel chains, airlines, and corporate players. These strengths allow Cleartrip to provide incredible service to its consumers.

New Partnerships Enable Cleartrip To Provide More To Its Users

Recently, Cleartrip announced the onboarding of airline brands such as AirAsia Berhad and Akasa Air. This is the brand’s step to extend the flight options for trips to Malaysia, Thailand, Indonesia, Australia and New Zealand. AirAsia has an extensive travel network and flies to 140 countries worldwide, while Akasa Air is popular in Southeast Asian nations.

According to the Vice President of Air Category, Cleartrip, Gaurav Patwari, “The onboarding of Akasa Air marks the beginning of an exciting chapter for Cleartrip.” The vice president stated the primary objective of Cleartrip is to become a one-stop destination for travel. He added, “The partnership with Akasa Air will further unlock affordable options for Cleartrip and Flipkart Travel users while ensuring a quality travel experience”.

Moreover, the brand formerly announced its partnership with Adani One to expand its services in domestic and international flights. The CEO of Cleartrip stated, “At Cleartrip, we are constantly devising new ways to reach our customers and make travel a seamless and hassle-free experience. By onboarding ourselves on the Adani One platform, we will make travel accessible to a larger demographic. This venture signals the beginning of a new and exciting chapter for us.” These partnerships have allowed Cleartrip to significantly expand its horizon and offer exciting deals to its users.

Growth In FY2022 Q4 Puts Cleartrip In A Better Position In The Stock Market

The company underwent major changes in its stockholding in 2021 as Flipkart acquired a 100% percent monopoly. Later in October 2021, Adani Enterprises gained a minor stake in Cleartrip stocks. However, the success of the OTA giant in recent years and its increasing popularity have attracted retail investors. As the market opened entirely in 2022, and the international restrictions relaxed significantly, Cleartrip recorded a 75% growth in its fourth quarter of FY2022 compared to Q3.

If you are a retail investor seeking investment options with the potential of huge returns, consider Cleartrip unlisted shares. Investing in industries that are growing in nature is recommended and is favoured by the experts’ analyses. Cleartrip is the leading player in Indian travel agencies, and its innovative business model and growth strategy are meant to bring great profit margins in the coming years. Head over to the brand’s page on Stockify to get a good overview of the profit trends, revenue growth rate, and earnings per share (EPS). To make your investment now in easy steps, connect with our expert professionals and start trading now!