The financial report of NSE for the third quarter of FY2023 and the consolidated nine months report give the latest credible overview of the largest stock exchange in India. The double-fold implication of the NSE financials makes them essential to comprehend. First, the financial report elaborates on the performance of the stock exchange and overall revenue, allowing the investors, stockholders, and NSE customers to rethink their faith in NSE. Secondly, the financial report of India’s leading stock exchange also represents the nation’s trade trends in recent months.

Let’s explore what the NSE financial report of December 2022 implies.

Key Highlights

NSE retained its top position as the world’s largest derivative exchange platform for another year. The highlights of financial statements for 9 months of FY2023 vs 9 months of FY2022 showed the general trend of growth in the market as well as in NSE volume and market share.

| Key Highlights Of Financial Reports For 9 Months Of FY2023 Vs 9 Months Of FY2022 | |||||

| Market Growth | NSEVolume Growth | NSEMarket Share | |||

| Contribution Margin | 20% | Contribution Margin | 19% | Contribution Margin | 93 % |

| Equity Options | 89% | Equity Options | 89% | Equity Options | 100 % |

| Equity Futures | 0.4% | Equity Futures | 0.4% | Equity Futures | 100 % |

| Interest Rate Future | 15% | Interest Rate Future | 2% | Interest Rate Future | 52 % |

| Currency Options | 119% | Currency Options | 122% | Currency Options | 96 % |

| Currency Futures | 65% | Currency Futures | 63% | Currency Futures | 69 % |

| Debt (RFQ Platform) | 99 % | ||||

It is clear that the contribution margin of the market grew by around 20% in the market and NSE volume. The contribution margin is marginal profit per unit sale and gives a good overview of the income generated. The NSE financial report for December Quarter shows market growth in all the domains, such as equity options, currency options, equity futures, interest rate futures, etc.

Revenue & Drivers In Q3 FY2023 Vs Q3 FY2022

The leading drivers for the revenue and profit for NSE in FY2023 were listing services, colocation charges, treasury income, and transaction charges. Compared to the previous year of Rs. 59 crores, the booking charges this year could only bring Rs. 43 crores. At the same time, the colocation charges generated Rs.161 crores in the December quarter of 2023 as compared to Rs.113 crores in 2022. The Treasury Income amounted to Rs.220 crores, a significant leap from Rs. 93 crores in 2022. However, the transaction charges grew by 31% to the amount of Rs. 2,367 crores. This was Rs. 557 crores higher than the 2022 figure of Rs.1,810 crores.

| Indicators | Q3 FY23 | Q3FY22 |

| Revenue | Rs.2,834 crs | Rs.2,115 crs |

| Expenditure | Rs.792 crs | Rs.564 crs |

| Op. margin | Rs.1,837 crs | Rs.1,462 crs |

| EBITDA | Rs.2,118 crs | Rs.1,611 crs |

| EPS (Rs.) (FV Re.1) | Rs 31.68 | Rs 23.46 |

| Net worth Rs. Crs. | 14,863 | 10,042 |

| Book Value per share Rs. | 300 | 203 |

2023 saw an increase in other market indicators, such as revenue, operating margin, EBITDA and book value per share. The net worth of NSE increased from Rs. 10,042 crores to Rs. 14,863 crores.

The Story That NSE Consolidated Financials Tell

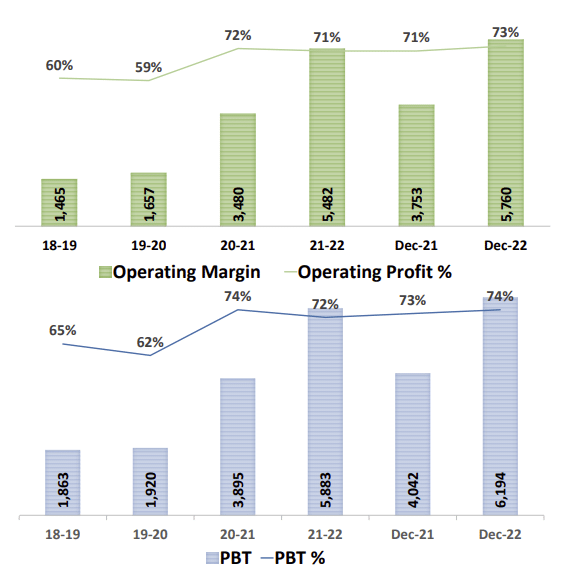

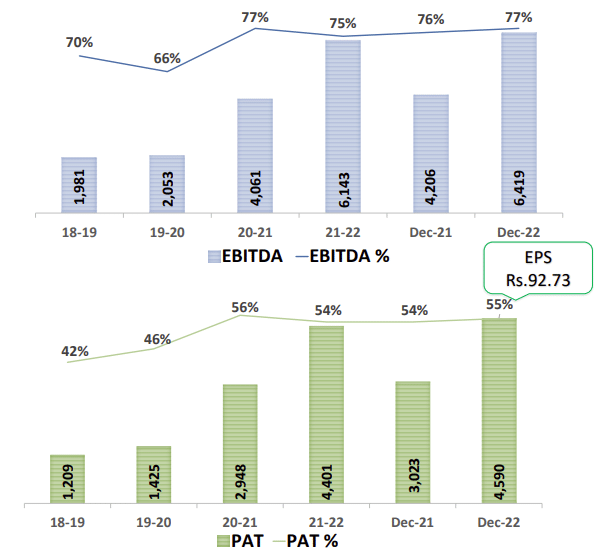

The NSE consolidated financials from 2018 to 2022 has highlighted a constant story of expanding the stock exchange market in India. This has been obvious in the increasing operating profit, Price Before Tax (PBT), Price After Tax (PAT), and EBITDA, as well as Earnings Per Share (EPS). Moreover, the graph below in the financial reports by NSE for the December quarter compares the market indicators between FY22 and FY23. The operating margin, profit and EBITDA increased by an average of 1.5 times which is a significant growth.

Also Read: Share Market Terminology Simplified (Bonds, Stocks, IPO, FPO, Growth Stock, Book Stock, Bullish, Bearish)

The overall growth in the stock exchange and revenue generated brings profit to the stock exchanges. However, it doesn’t mean a loss for another party but simply a development in the business landscape and stock trading, where many make substantial profits. Even so, the accepted risk remains in the share market, although the market is generally becoming more favourable.

Make Large Returns By Investing In NSE

NSE is the leading stock exchange in India, incorporated in 1994. It is a revolutionary technology-based exchange platform in India that started with the concept of providing fully integrated electronic trading and providing more transparency to investors. Given the company’s incredible performance over the years, the NSE unlisted shares have become incredibly popular in the grey market. NSE is not a public limited company by its share type, and it is yet to organise an IPO. Therefore, the shares of NSE are only available in unlisted markets.

If you wish to generate significant returns for your investments, invest in companies like NSE that dominate the stock trading landscape of India. These stock exchanges are also the leading financial players and have the expert know-how that makes them capable of generating massive revenues and continuing on a growth path for years. Head over to the NSE page on Stockify to closely examine the real-time price and changing market indicators such as EPS and EBITDA growth. The share price is constantly changing; therefore, Stockify regularly updates the NSE share price on Stockify.

Diversify Your Portfolio

Although NSE is one of the best-unlisted shares to invest in now, including more than one stock in your portfolio is a good practice. The experts recommend that you should diversify your portfolio by stocks from many industries to save yourself from adverse markets or sudden changes in many industries. Stockify features high-grossing unlisted shares from sectors like healthcare, pharmaceuticals, automobiles, and information technology. Explore these unlisted stocks and start investing now. Moreover, the expert team of Stockify are always one call away in case you have a query or simply want to invest in new shares. Therefore, don’t hesitate to connect with them. Happy Trading!